Registered Index Linked Annuity

Registered Index Linked Annuities (also known as Structured Variable Annuities or Buffer Annuities) are tax-deferred insurance vehicles that provide upside potential with a defined degree of downside protection. The investor assumes the portion of the market risk that is in excess of the "buffer" or the initial losses before reaching the "floor", but in exchange receives a higher participation rate in market performance.

The Market for Registered Index Linked Annuities1

Registered Index Linked Annuities (RILAs) were first introduced by AXA (now Equitable) in 2010, and are now offered by multiple carriers. In 2021, increased interest in registered index linked annuities led to record-breaking sales—$39B, 62% higher than 2020. Registered index linked annuities are predicted to experience continued growth as investors seek solutions offering a balance of protection and growth.

DPL's View: Registered Index Linked Annuities

These measures are created within the context of insurance products.

How Registered Index Linked Annuities Work

Registered index linked annuities can be thought of as a hybrid between indexed and variable annuities, as most of a client’s premium is allocated to fixed income instruments, while a small portion is allocated to other derivative investments. Because of the unique nature of investing a portion of the assets into derivative instruments, the insurance company is often able to generate higher yields, allowing for higher cap rates and, thus, providing the potential for greater returns to the client.

Depending on the product structure, registered index linked annuities may offer a buffer or floor option, where the insurance company either covers a specific percentage of the market downside (buffer) or the insurance company caps a specific percentage of market downside (floor). For example, if the market were to fall 15% and the product has a 5% buffer feature, the client would lose 10%, as the insurance company covers the first 5%. If the product has a 5% floor option, the client’s losses would be capped at 5%, and the insurance company would take on the rest of the 10% loss.

Problems with Commissioned Registered Index Linked Annuities

How to Think About Commission-Free Registered Index Linked Annuities

Registered Index Linked Annuities fall in the middle of variable annuities and fixed indexed annuities in terms of risk tolerance. Investors may purchase registered index linked annuities as an equity allocation replacement to capture upside while reducing portfolio risk, as these products often provide cushion against major market losses.

When your client needs:

PRINCIPAL PROTECTION: Registered index linked annuities are typically used for clients nearing retirement. They offer a level of protection against sequence of returns risk, while also providing the potential for higher returns due to higher cap rates than other structured insurance vehicles.

EQUITY REPLACEMENT: Registered index linked annuities can be utilized to de-risk portfolios from large equity allocations, while still providing market exposure.

Registered Index Linked Annuity

12021 Annuity Sales Highest In 13 Years, LIMRA Reports (2/2022)

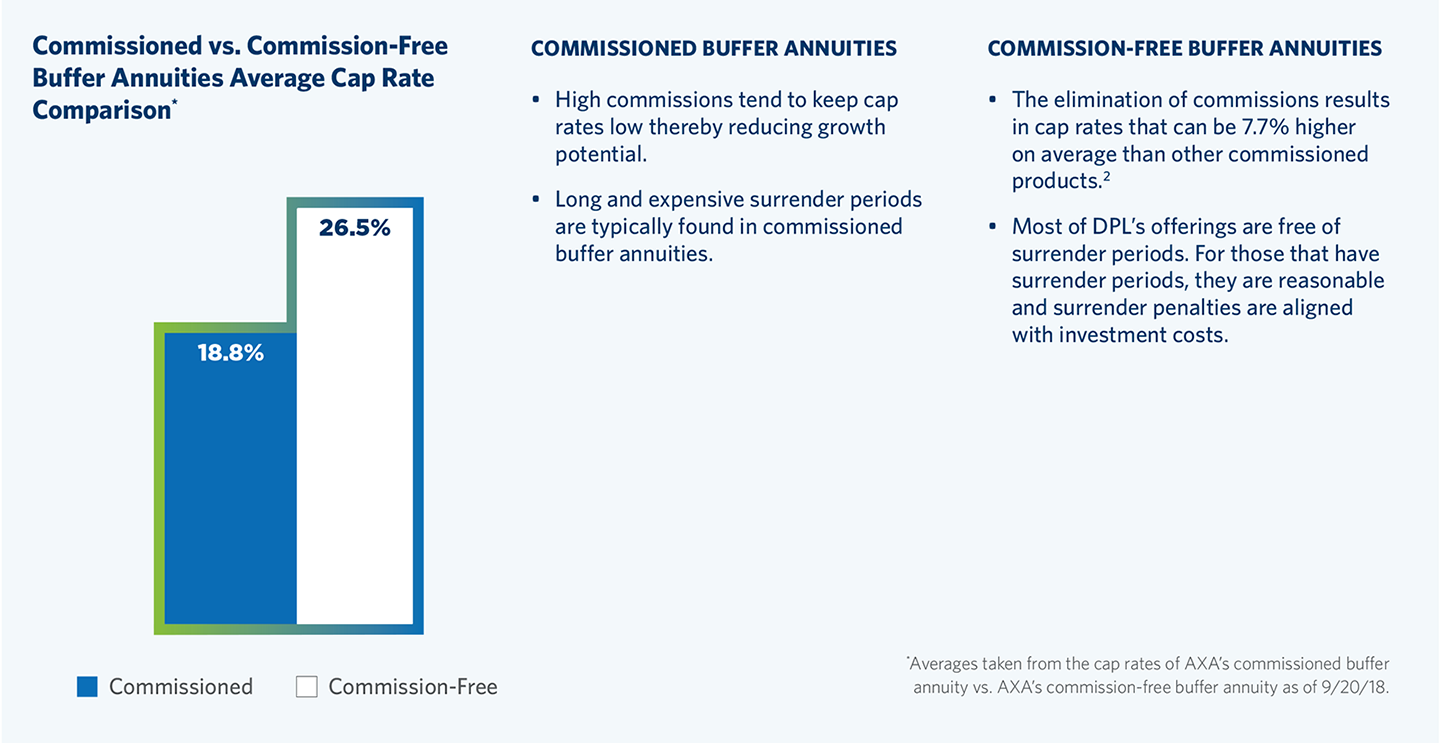

2Difference taken from the average cap rates of AXA’s commissioned SVA vs. AXA’s commission-free SVA as of 7/22/2020.

Variable annuities are contracts purchased from a life insurance company that are designed for long-term retirement goals and are subject to market risk, including loss of principal.

No investment strategy insures a profit or protects against losses in a down market.

All guarantees are based on the financial strength and claims-paying ability of the issuing insurance company.

The purchase of an annuity within a retirement plan that already provides tax deferral under sections of the Internal Revenue Code results in no additional tax benefits. An annuity should be used to fund a qualified plan based upon the annuity’s features other than tax deferral. All annuity features, risks, limitations, and costs should be considered prior to recommending the purchase of an annuity within a tax-qualified retirement plan. In addition to surrender charges, withdrawals are subject to income tax.

Have more questions about our Registered Index Linked Annuity options?

Call us at 888.327.0049 to speak to a DPL Consultant.