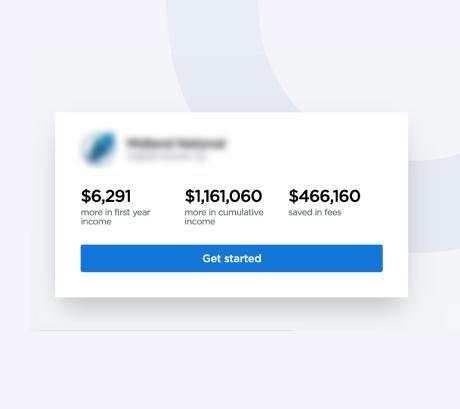

Compare current annuities to Commission-Free options to determine whether pricing and benefits can be improved.

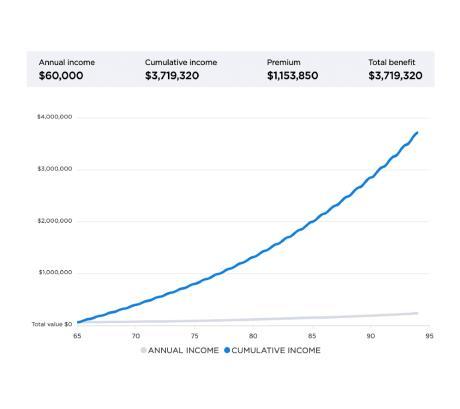

See how Commission-Free annuities can generate income more efficiently than fixed income using our Guaranteed Income Analysis tool.

See how the income generated by Commission-Free annuities compares to the income generated by an investment strategy without an annuity.

Insurance offers meaningful benefits clients want and need, like guaranteed income, principal protection and tax deferral. DPL works with RIAs to help them incorporate Commission-Free annuities and best available insurance into their practices to differentiate their offering, deliver better client outcomes and grow AUM.

Stop sending clients down the road to an insurance salesperson. Bring insurance under your fiduciary umbrella and ensure your clients are presented only with products you approve.

Meet increasing client demand for broader services. Deliver comprehensive financial planning that includes Commission-Free annuities and life insurance, and a more complete client experience.

Increase AUM by retaining or attracting insurance business. With all the benefits Commission-Free insurance can bring to your clients and practice, it doesn’t make sense not to expand into insurance.