Annuity Misconceptions: What You Should Know

When it comes to retirement planning, annuities are one of the most misunderstood financial tools. Misconceptions and outdated beliefs often prevent investors from exploring how annuities can provide guaranteed income, protect assets, and support long-term financial security. By clearing up the most common myths, you can better understand the role annuities may play in your retirement strategy.

Misconception #1: “I won’t run out of money — I don’t want or need guaranteed income.”

The Alliance for Lifetime Income reports 51% of consumers feel they do not have enough retirement savings to last their lifetime, and 32% are not confident they will have enough to cover basic monthly expenses.1

Retirees biggest fear is outliving their assets — and their concern is understandable.2

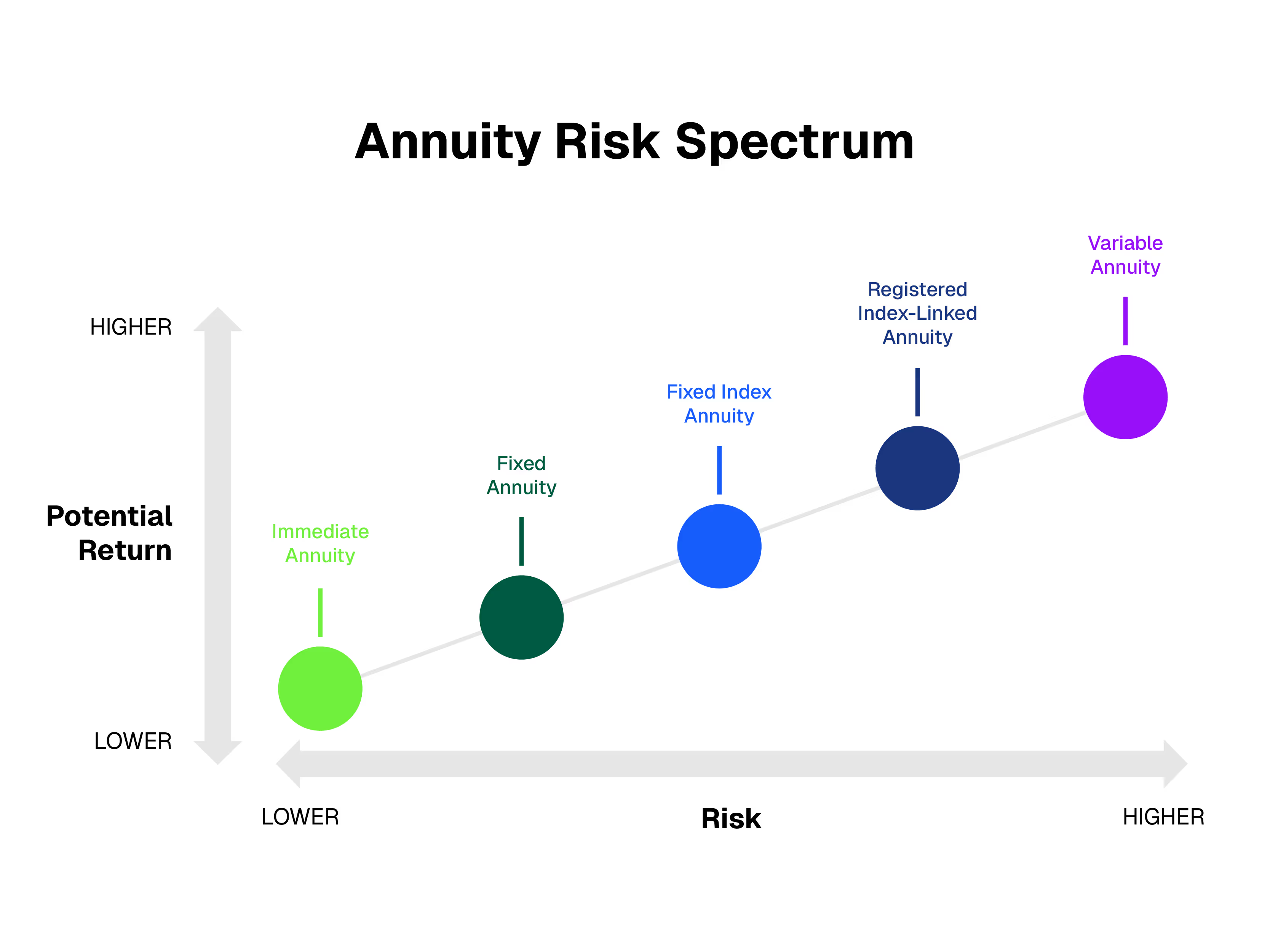

Annuities are perhaps the only way to mitigate longevity risk, but they are also a more efficient means of generating retirement income. Annuities can quickly outperform fixed income in generating retirement income and provide payouts long after fixed income portfolios would be depleted. Annuities should be considered, especially if you are likely to outlive the average life expectancy.

Misconception #2: “I don’t want or need annuities.”

The annuity market is a $4T market — showing a clear desire for guaranteed income among consumers and retirees.4 The Alliance for Lifetime Income reports 85% of investors are interested in owning an annuity that guarantees lifetime income, or already own one.1

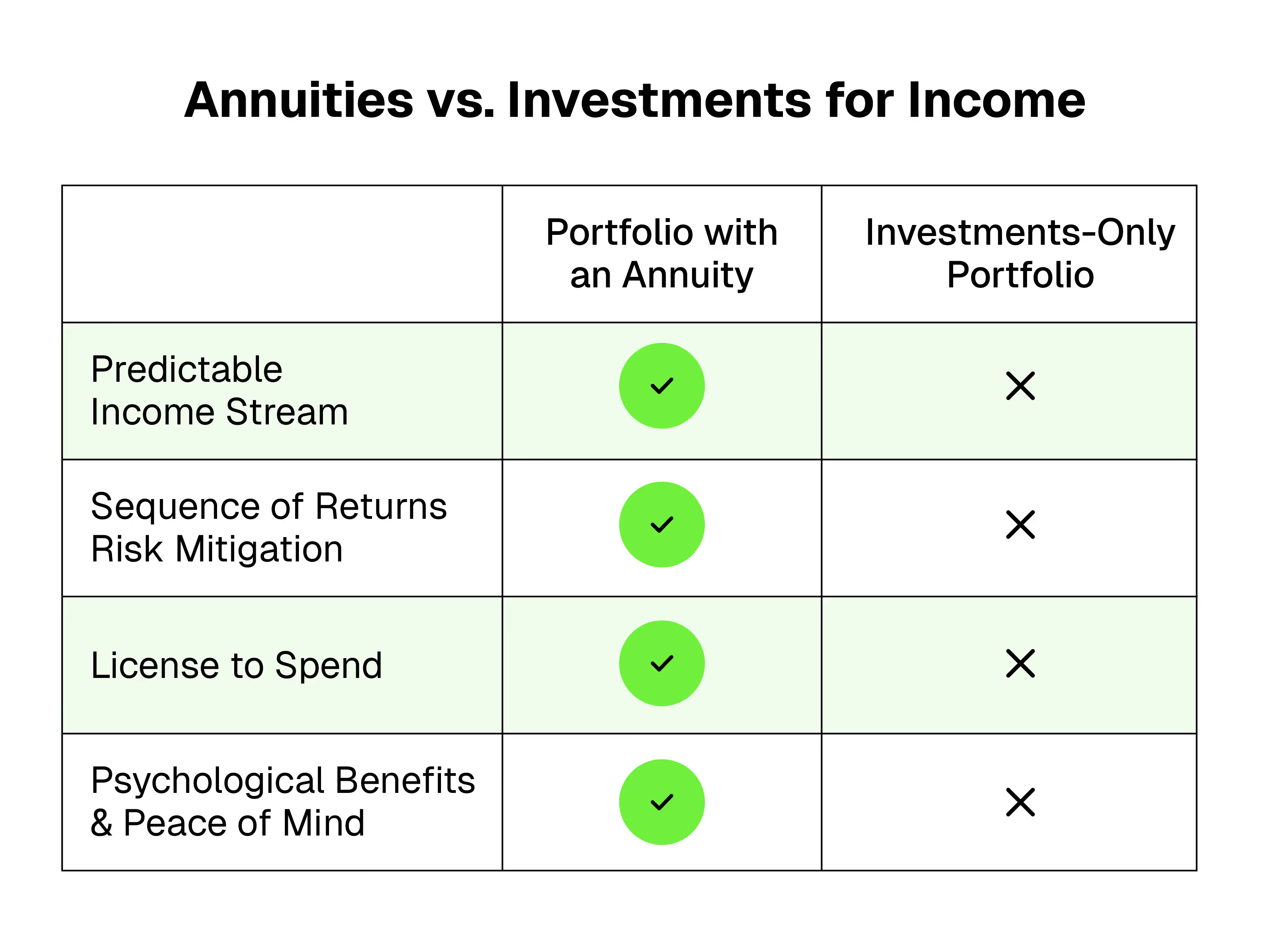

The psychological benefits of annuities are well documented, including peace of mind and increased happiness in retirement.5 Not only can they provide that peace of mind, annuities can also provide a budget if you tend to overspend, or a freedom to enjoy retirement if you may be afraid spending will cause you to run out of money in later years.

Misconception #3: “My fixed income portfolio can outperform an annuity.”

An annuity is built on the insurance carrier’s balance sheet, which resembles a large, scaled bond ladder. So, insurance products will often perform like fixed income investments, but where they shine relative to traditional fixed income portfolios is in the income they can generate.

We encourage you to run the numbers to see how an annuity is able to provide secure retirement income relative to a fixed income strategy.

Misconception #4: “Income is generated through annuitization.”

Annuitization is the process of converting an annuity investment into a series of periodic income payments. Annuitization is an irreversible allocation of funds — and you may lose cash value and a death benefit when if you annuitize.

LIMRA reports only about 5% of all annuities sold in the United States are annuitized.6 Single premium immediate annuities (SPIAs) generate income through annuitization. For every other annuity — while you can annuitize — it is more common for income to be generated through riders. This is important because you are not turning over assets to the insurance company to generate income. When income is generated using a rider, cash value remains available until it is depleted through distributions.

Annuities are a powerful tool to generate income in a retirement plan — income now, income soon, or income later.

Without annuitization, annuities can provide reliable income to a retirement portfolio based on your liquidity, flexibility, and payout rate preferences.

Misconception #5: “All annuities have surrender periods.”

Commission-Free annuities more often than not do not have a surrender period.

If they do have a surrender, it’s more analogous to an early withdrawal or early redemption penalty rather than a charge to recoup a commission. Where surrender periods exist, they enable the insurance carrier to better manage duration risks to the portfolio and thus pay you a higher interest rate.

For Commission-Free products with surrender periods, the surrender periods are typically shorter, and products have lower fees than their commissioned counterparts.

Misconception #6: “I haven’t looked at annuities because bond yields are low.”

Bond yields being low actually makes annuities more appealing compared to fixed income. When bond yields are low, the shortfall in retirement income needs to be met through the sale of equities, harming portfolio returns and subjecting you to sequence of returns risk. The article “Bonds or Annuities? What’s the Best Way to Generate Retirement Income?” provides analysis by academics Wade Pfau, David Blanchett and Michael Finke.

Annuities have evolved, yet many investors still hold onto outdated beliefs that prevent them from seeing their value. By separating misconceptions from the truth, it becomes clear that annuities can be a powerful way to generate reliable income, reduce financial stress, and strengthen retirement strategies.

Whether you’re seeking income now, soon, or later, understanding the truth about annuities ensures you can make confident, informed decisions about your financial future.

DPL has several tools to help you learn more about commission-free annuities and see how these solutions fit in a retirement portfolio.

[press-a-contact-location]

1 ALI 2023 PRIP Survey

2 Cerulli

3 Insured Retirement Institute

4 Insurance Information Institute

5 Michael Finke, Standard Deviations Podcast

6 Annuity.org

7 MYGA rates available through DPL compared to median US Treasury Yield and comparable CDs via Fidelity, November 17, 2023.

.avif)